How Marketers can close the measurement confidence gap

- 02 June, 2022 10:43

In a world of exploding choice, fleeting loyalty, and increasing media fragmentation, there is no short-selling the importance of establishing and fortifying a brand’s relationship with its consumers.

To get a better, more complete view of consumers, marketers should focus on strategies that give them visibility into all engagements—not just channel- or platform-specific look-ins. Robust and accurate data that measures, optimises and proves ROI, must be marketers’ north star for understanding and engaging the consumer and for measurement and attribution that enables the highest ROI.

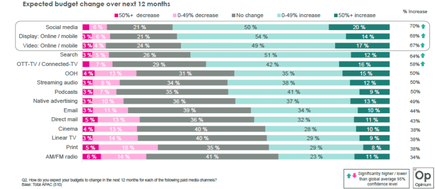

Nielsen’s 2022 Annual Marketing Report revealed that Asia-Pacific marketers plan to significantly ramp up their ad spending on digital media platforms over the next year. Social media ad budgets, for example, will increase by up to 70%; closely followed by online and mobile display (68%); and online and mobile video (67%).

Despite these big plans for amplified advertising presence across paid digital channels, the report findings also highlighted a distinct lack of confidence among Asia Pacific marketers on their ability to adequately measure effectiveness and, ultimately, ROI.

Only 55% of Asia-Pacific marketers surveyed say they are confident in measuring ROI across social media—well below the global benchmark of 64%, and just two-in-five (42%) are confident in measuring full-funnel ROI (compared with 54% of global marketers).

Somewhat surprisingly, however, 77% of Asia-Pacific marketers expressed satisfaction with the tools they have to measure their marketing activities. The gap between confidence in full-funnel ROI measurement and overall martech satisfaction presents an opportunity for vendors to provide assurance in measurement capabilities where confidence is lackluster.

Lower full-funnel ROI confidence among marketers may stem from standard industry solutions not typically accounting for both upper- and lower-funnel marketing efforts. To address this issue, marketers can run Marketing Mix Models (MMMs) to optimize channel mix for short-term sales, and then optimise channel mix for awareness or other upper-funnel metrics. The results of these models can be weighted together to create a more balanced plan that supports both short-term needs and long-term ambitions.

As it always has been, data is a marketer‘s guiding light. But that data should be plugged into scalable marketing solutions that brands of all sizes can use to approach decisions with precision and arrive at reliable, growth-driving outcomes.

KEY RECOMMENDATIONS FOR CLOSING THE MEASUREMENT CONFIDENCE GAP

1.Prioritise tech investments that validate campaign effectiveness.

Marketing budgets are no stranger to scrutiny, but the past two years shine an even brighter light on the importance of efficient and effective spending. With relatively low measurement confidence, especially with respect to next-gen channels, marketers should focus on solutions that provide the confidence they need to prove the effectiveness of their spending.

2.Encourage corporate agility with strong consumer insights.

Having insight into the consumer is the best way to stay agile and adaptive. Investments in robust data sources to learn real-time changes in consumer attitudes, behavior and media engagements will be money well spent.

3.Optimise throughout the funnel.

Individual industry solutions don’t typically account for both lower- and upper-funnel marketing efforts. To validate short-term sales and seed long-term growth, consider running MMM studies for both short- and long-term ROI.

Download the full Nielsen's 2022 Global Annual Marketing Report here.