Latest martech lumascape shows thriving marketing tech sector

- 24 April, 2020 11:07

The 2020 lumascape

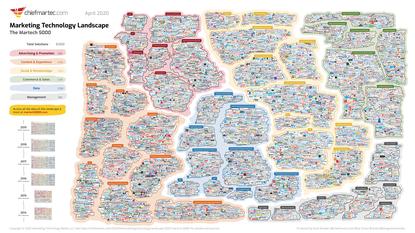

Scott Brinker has officially debuted the 2020 edition of the Marketing Technology Landscape featuring more than 8000 marketing and advertising vendor solutions.

The year-on-year martech lumascape reports a 13.6 per cent increase in solutions on offer, even as 615 of the 2019 listees came off the map as a result of either acquisition or consolidation. Taking those 615 from the 2019 map, growth of new entries was 24.5 per cent year-on-year.

Brinker also noted an array of martech companies acquired from the 2019 lumascape of 7040 solutions were picked up by vendors not already featured, representing a change in ownership rather than a reduction in total vendor numbers.

Across solution categories, data showed the highest year-on-year growth at 25.5 per cent, with 1258 solutions listed on the lumascape. The second-highest growth category was management solutions, up 15.2 per cent to 601 solutions.

Other well-represented categories included content and experience (1936 solutions, up 5.6 per cent); social and relationships (1969, up 13.7 per cent); and commerce and sales (1314 solutions, up 9 per cent).

The latest report also shows fastest growing subcategory in each category, by percentage of growth. Brinker noted physical world interactions, such as print, retail proximity and Internet of Things (IoT) tools, along with data governance and privacy, video marketing, conversational marketing and chat, and project and workflow management, led the pack.

Since commencing the mapping activity in 2011, Brinker cited a 5233 per cent growth in martech solutions available to marketers today. Yet even with a long tail of solutions still available, he cited consolidation across the market, with a small group of enterprise solutions dominating global martech market share.

Then there are a few hundred category leaders, Brinker said. “Their solutions are more focused and dive deeper on a particular capability — say, social media management — but they still have tens of millions or even hundreds of millions of dollars in revenue,” he said, adding martech is a $121 billion industry overall.

As for where things are headed, Brinker predicted a rich and diverse ecosystem of players well into the next decade.

“Even with plenty of consolidation, the volume of net new software creation — although likely more ecosystem-oriented software — will continue to be robust,” he commented. “There is an ever-renewing spring of opportunities to make marketing better and few barriers to building an app in the cloud to address them.”

The impact of COVID-19 will nonetheless be felt, Brinker said, noting reduced business spending due to the uncertainty, along with marketing operations being stretched thin to deal with the crisis, and reduced VC funding currently being available.

However, he cited several tailwinds that should continue to propel martech investment and innovation forward, including less expensive products that thrive in platform ecosystems, the push around performance marketing and the overall lean-in to digital capability and transformation.

“The world is going to continue to become more digital. If anything, this crisis will accelerate the motivation for firms to embrace digital operations and digital customer experience. And that’s where martech thrives,” Brinker added.

Follow CMO on Twitter: @CMOAustralia, take part in the CMO conversation on LinkedIn: CMO ANZ, follow our regular updates via CMO Australia's Linkedin company page, or join us on Facebook: https://www.facebook.com/CMOAustralia.